Hope your year is off to a good start!

Contrary to what the media outlets are portraying, there’s a renewed sense of confidence out there. Buyers are starting the year out with both a sense of acceptance, and an overall increase of confidence, as we’re starting to see more buyers gearing up to make purchases in 2023. We’ve personally had a handful of new buyers reach out in the last two weeks alone. We’re also starting to see more multiple offer situations than we had in previous months, which signals that buyers are trying to get ahead of a potential spring rush, when we typically see prices come up.

While the year ended with slower sales and more price negotiations, increased demand is evident, as well-priced and quality homes have been receiving multiple bids. Yes, many buyers are holding tight and feeling insecure about their jobs and the economy, however, for every buyer on the fence, there seems to be an equal number of buyers that are feeling confident and jumping on opportunities out there. I am noticing that sellers in general are more realistic about price now than they’ve been at any point last year. While January and February inventory will be at a low point , in my opinion there will be more listings hitting the market compared to the last two months, which will give buyers eager to secure homes in advance of the spring market some good opportunities.

My prediction for next year…

My prediction is 2023 will see inventory levels in the 2–3 month range throughout the year — still a couple months short of a buyer’s market. So, when presented and priced correctly, homes will sell. Buyer demand will likely increase as rates and inflation continue to trend lower. With many buyers and sellers having waited, the pent-up demand will result in more listings and more sales. I predict that prices will stay generally flat from January through March, and in April we’ll start to see a small, but not significant, bump in prices. When comparing year-over-year prices, the median prices will show decreases in the first several months of the year since prices rose sharply last January - April.

Experts all agree that interest rates will likely continue to trend down but will hover around 6% for much of 2023 and may dip into the high 5’s by the end of next year. For “jumbo” loans (loan amounts over $977,500) it’s possible to secure interest rates in the 5.25%-5.75% ranges. Also helpful to current buyers is that many lenders are offering no-cost refinances for the first three years so that buyers can secure loans now and easily refinance once rates come down.

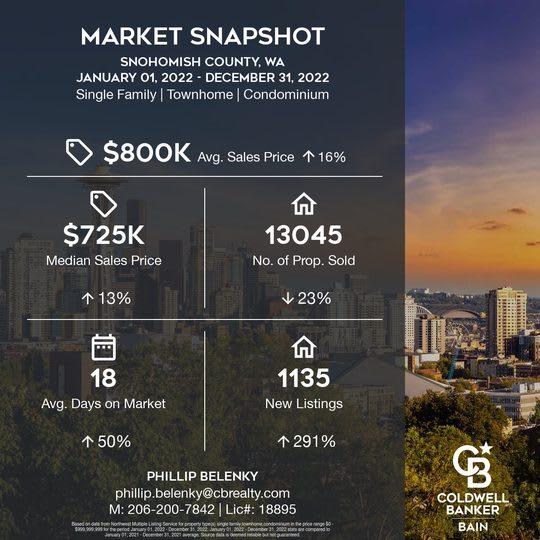

Here are some additional market stats

- King County prices for single-family homes increased 8.7% in 2023 compared to 2022. Condo prices rose similarly, at 8.9%.

- Snohomish County prices for single-family homes rose 12.5%, and condos rose 12%.

- For the NWMLS coverage area, December prices were down .5% from the previous December which was the first year-over-year decline in over a decade!

- December median price fell 14% from the peak in May 2022.

- Overall sales volume last month was down 30% from the previous December.

- December ended with 2.1 months of inventory. King and Snohomish Counties however ended the year under 2 months of inventory.

- If you or someone you know would like to learn more about the current market, don’t hesitate to reach out. Each situation is different and we’re here to help. I’m just a call/text/email away! -Phillip